Is Oklahoma Really the Most Expensive State for Homeowners Insurance?

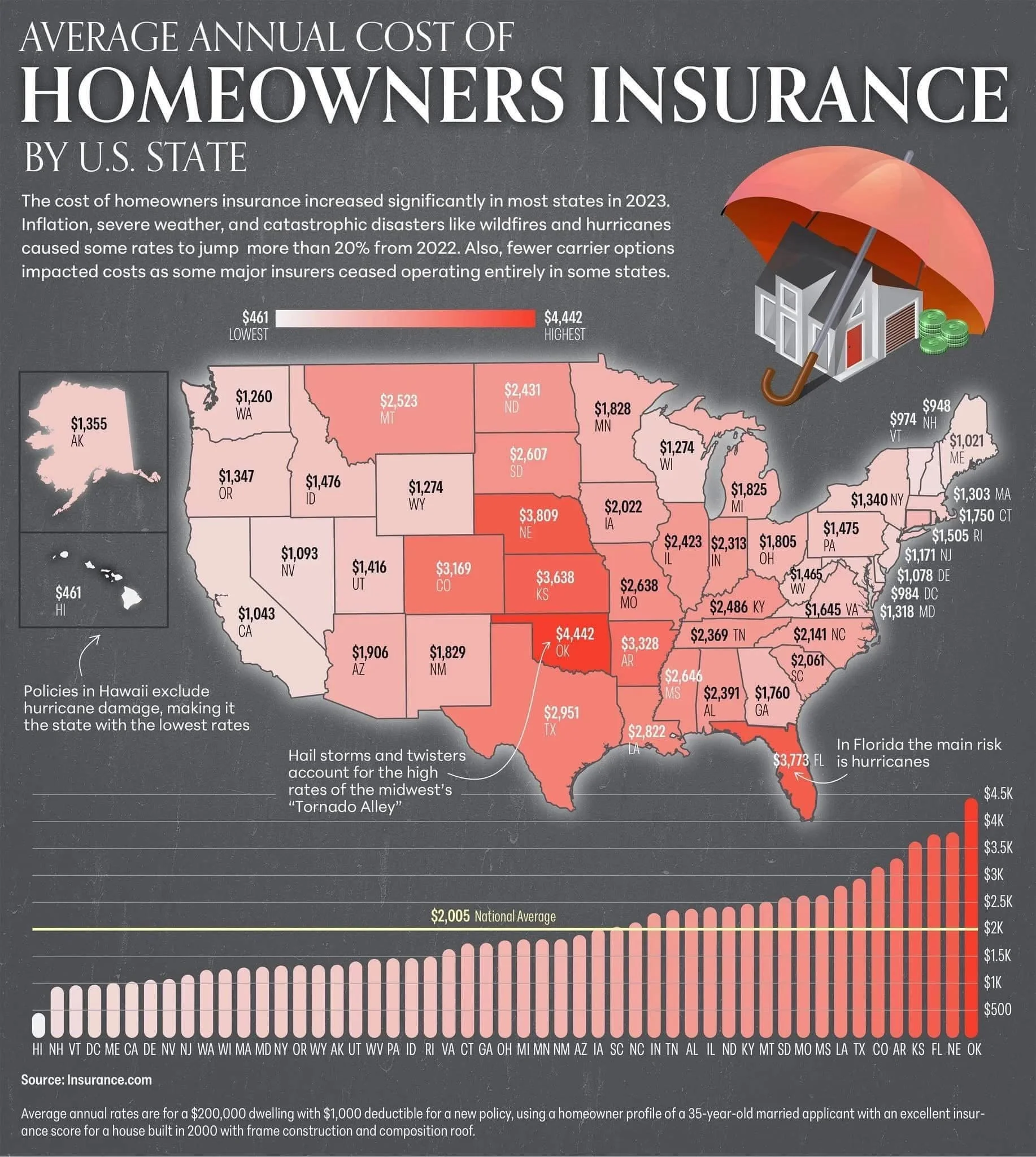

Homeowners in Oklahoma are paying the highest insurance rates in the country, with an average annual premium of $4,442 according to recent data. That’s more than twice the national average of $2,005 and significantly higher than neighboring states like Texas ($2,951) and Kansas ($3,773). But here’s the real question: Are Oklahomans truly at greater risk, or are we being unfairly burdened with sky-high premiums that may subsidize losses in other states?

Understanding the Risk Factors

Oklahoma sits in Tornado Alley, which undoubtedly increases the likelihood of severe wind and hail damage. Insurers factor in this risk, leading to higher premiums. However, when compared to other high-risk states, something doesn’t quite add up.

Florida is another disaster-prone state where hurricanes are a major risk, yet its average premium is $3,796—still lower than Oklahoma’s rates.

Nebraska ($3,809) and Kansas ($3,773) face similar tornado risks but have lower premiums.

California ($1,750), a state known for devastating wildfires and earthquakes, has less than half of Oklahoma’s rate.

If Oklahoma’s risk is indeed the highest, then the premiums make sense. But if other states with comparable or worse risks have lower rates, something else might be driving these costs.

Are Oklahoma Homeowners Paying for Other States’ Disasters?

One possible explanation is that Oklahoma’s insurance market is absorbing losses from national insurers that have been hit hard by disasters elsewhere. In 2023, some major insurers pulled out of states like California and Florida, reducing competition and potentially shifting costs onto states where they still operate. Since Oklahoma is home to several large insurance providers, it’s possible that we’re shouldering part of the financial burden for claims in places like Florida, California, and Louisiana.

Additionally, property values in Oklahoma are generally lower than in many coastal or metropolitan areas. If home values are lower, shouldn’t insurance premiums also be lower? A $200,000 home in Oklahoma costs more to insure than a million-dollar home in some other states, raising questions about how these rates are calculated.

The Need for Transparency in Homeowners Insurance Pricing

It’s clear that many Oklahoma homeowners are currently facing extremely high insurance costs, but whether these costs are truly justified remains a topic of significant debate. Are insurers charging Oklahoma residents more because of legitimate and assessed risks, or are we merely being used to help balance losses that are occurring in other states? Without more transparency and clarity from the insurance industry, homeowners in Oklahoma may never truly know the underlying reasons for these elevated rates.